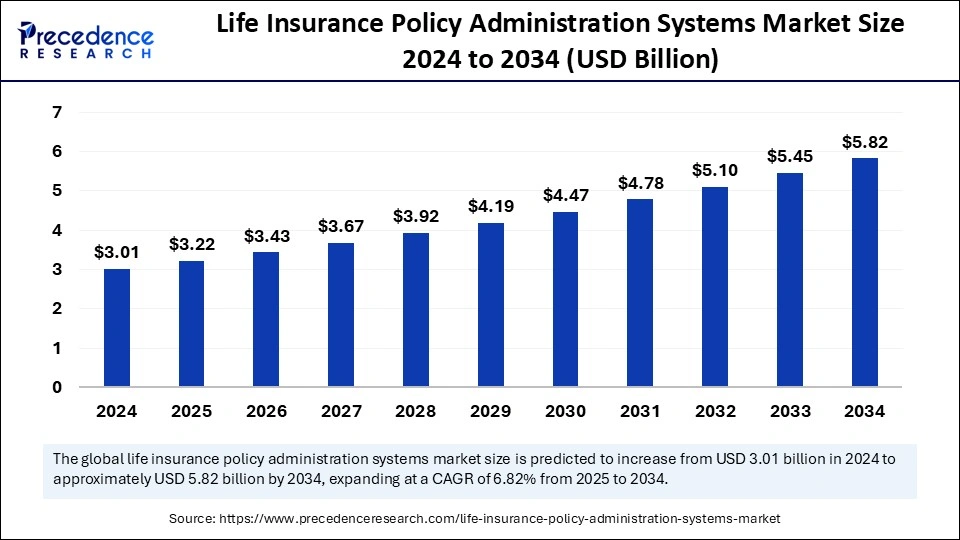

The global life insurance policy administration systems market size was valued at USD 3.01 billion in 2024 and is expected to reach around USD 5.82 billion by 2034, growing at a CAGR of 6.82%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5811

Life Insurance Policy Administration Systems Market Key Points

-

In 2024, North America emerged as the leading regional market.

-

Asia Pacific is gaining momentum and is set for rapid expansion.

-

Europe is positioned for notable growth in the near term.

-

Cloud-based solutions were the preferred technology in 2024.

-

On-premise systems are expected to witness increasing adoption soon.

-

Individual life insurance remained the most widely adopted policy type in 2024.

-

Group life insurance is projected to grow at a strong pace.

-

New business processing was the most utilized application in 2024.

-

Underwriting is anticipated to grow faster than other application areas.

-

Single-tenant models dominated in 2024.

-

Multi-tenant deployments are emerging as a high-growth segment

Role of AI in Life Insurance Policy Administration Systems Market

Artificial Intelligence is revolutionizing life insurance policy administration by streamlining operations, enhancing accuracy, and improving customer experience. AI-powered systems are automating traditionally manual processes such as policy issuance, underwriting, claims management, and customer service, significantly reducing turnaround time and operational costs.

Intelligent chatbots and virtual assistants are providing 24/7 support, handling queries, and guiding customers through policy-related actions, while natural language processing (NLP) is being used to interpret and process complex documents with speed and precision. Machine learning algorithms also help insurers assess risk more effectively by analyzing large volumes of customer and behavioral data, enabling more personalized and accurate underwriting decisions.

Additionally, AI is enhancing fraud detection and compliance in life insurance by recognizing unusual patterns and alerting stakeholders in real time. Predictive analytics, a core AI application, is enabling insurers to forecast customer needs, policy lapses, and mortality risks, helping them create more targeted offerings and retention strategies.

Cloud-based AI integration within policy administration platforms allows insurers to access scalable, real-time insights, improving agility in responding to market changes. As digital transformation accelerates, AI is becoming a key enabler of innovation, helping insurance providers build smarter, more efficient, and customer-centric policy administration systems.

Life Insurance Policy Administration Systems Market Growth Factors

The growth of the Life Insurance Policy Administration Systems Market is largely driven by the digital transformation in the insurance industry, with increasing demand for automation and personalized services. Insurers are adopting advanced technologies like AI, machine learning, and cloud computing to streamline policy lifecycle processes, improve operational efficiency, and enhance customer experience.

The shift towards automation in underwriting, claims management, and customer service is reducing costs and improving turnaround times, while also meeting rising consumer expectations for personalized and seamless experiences.

Additionally, the growing need for regulatory compliance and the integration of advanced analytics are further fueling the market’s expansion. Cloud-based solutions are providing insurers with scalable, cost-effective alternatives to traditional on-premise systems, improving flexibility and reducing infrastructure costs.

With increasing competition and a need to differentiate, insurers are turning to efficient policy administration systems to stay agile, reduce operational costs, and offer innovative services that meet evolving customer demands.

Market Overview

The Life Insurance Policy Administration Systems Market is growing rapidly due to the increasing adoption of digital technologies in the insurance industry. Insurers are leveraging AI, machine learning, and cloud-based solutions to streamline policy management, enhance efficiency, and offer better customer service. These technologies are driving the shift towards more automated and customer-centric policy administration systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.82 Billion |

| Market Size in 2025 | USD 3.22 Billion |

| Market Size in 2024 | USD 3.01 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.82% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Type, Application, Deployment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The demand for automation is one of the key drivers, as insurers seek to reduce operational costs and improve processing speeds. Additionally, the need for more personalized services and the growing regulatory pressures are pushing insurers to modernize their systems and ensure compliance, thus further fueling the market growth.

Opportunities

There are significant opportunities in the widespread adoption of cloud-based solutions, which offer scalability and cost-effectiveness. Additionally, AI and data analytics are opening doors for personalized offerings and improved risk assessment, especially in emerging markets where insurers are increasingly modernizing their infrastructure.

Challenges

The primary challenges include high upfront costs associated with implementing new systems, as well as the complexity of integrating these systems with existing legacy infrastructures. Insurers also face difficulties in navigating evolving regulatory environments and ensuring robust cybersecurity within their digital platforms.

Regional Insights

North America leads the market due to its advanced technological infrastructure, while Asia Pacific is expected to grow at the fastest rate, driven by rapid digital transformation in the region. Europe is experiencing steady growth as insurers modernize their systems to meet rising customer expectations and regulatory demands.

Life Insurance Policy Administration Systems Market Companies

- Majesco

- Accenture Life Insurance Solutions Group

- Accenture Plc

- Oracle

- Insurity

- EXL

- Infosys

- FAST Technology

- Edlund

- EIS Group Inc.

- AgencySmart

Latest Announcements

- In January 2025, Atsushi Egawa, CEO of Accenture, announced that Meiji Yasuda’s initiatives for becoming the most accessible and industry-leading life insurer are innovative as they integrate manual roles with digital technologies.

- In August 2024, Jason Wynne, the Global Vice President of the Finance, Risk, and Compliance Product Development of Oracle Financial Services, announced that Resolution Life Australasia found a solution to deliver an effective response to emerging business demands and comply with new accounting standards such as IFRS 17.

Recent Developments

- In September 2024, the Life Insurance Corporation (LIC) announced a collaboration with tech giant Infosys for the development of a next-generation digital platform that will serve as the foundation of new high-importance business applications such as portals, digital branches, customer and sales super applications, etc.

- In January 2025, Majesco announced the selection of Majesco Intelligent Claims for P&C by Celina Insurance Group to transform claim operations, improve productivity, optimize the business, and enhance customer experiences.

Segments Covered In the Market

By Technology

- Cloud-Based

- On-Premise

- Hybrid

By Type

- Individual Life Insurance

- Group Life Insurance

By Application

- New Business Processing

- Underwriting

- Policy Administration

- Claims Management

- Billing and Accounting

By Deployment

- Single-Tenant

- Multi-Tenant

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Customer Self-service Software Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/