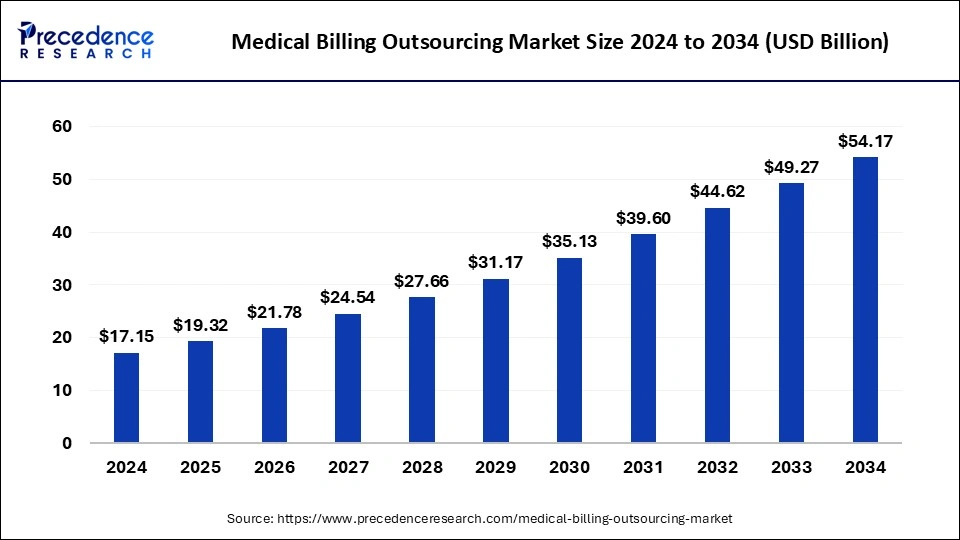

The medical billing outsourcing market size is calculated at USD 17.15 billion in 2024 and is expected to attain around USD 54.17 billion by 2034 at a CAGR of 12.00%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1103

Key Points

- North America led the global market with the largest market share of 48% in 2024.

- By Component, the outsourcing segment has held the largest revenue share of 53% in 2024.

- By Service, the front end segment has held the highest market share of 39% in 2024.

- By End-Use, the hospital segment had the biggest market share of 47% in 2024.

Market Dynamics

Drivers

The rising burden of administrative tasks on healthcare providers is a key driver for the medical billing outsourcing market. Many hospitals and clinics are struggling with staff shortages, making it difficult to handle billing operations efficiently.

By outsourcing medical billing, healthcare providers can focus more on patient care while ensuring accurate and timely claim submissions. Additionally, insurance companies have introduced more stringent reimbursement policies, increasing the need for specialized billing expertise to reduce claim denials and payment delays.

Opportunities

Cloud-based medical billing solutions are providing new growth opportunities for outsourcing companies. Cloud technology enables real-time access to billing data, seamless integration with EHR systems, and enhanced scalability for healthcare providers.

Additionally, the growing demand for value-based healthcare models has increased the need for accurate coding and streamlined billing processes, which third-party service providers can efficiently manage. Outsourcing firms that offer end-to-end revenue cycle management services are expected to benefit the most from this trend.

Challenges

Interoperability issues between different healthcare IT systems present a major challenge in medical billing outsourcing. Many healthcare organizations use various software platforms that may not be fully compatible with outsourced billing systems, leading to inefficiencies and data transfer issues.

Additionally, concerns over patient data confidentiality and compliance with legal frameworks such as HIPAA and HITECH Act add complexity to outsourcing agreements. Market competition among billing service providers also creates pricing pressures, affecting the profitability of outsourcing firms.

Regional Analysis

North America remains the largest market for medical billing outsourcing, with the U.S. driving growth due to its highly fragmented insurance landscape and rising administrative costs. Europe is also witnessing steady adoption, particularly in countries with universal healthcare systems looking to enhance efficiency.

Asia-Pacific is emerging as a fast-growing region, driven by the increasing demand for cost-effective billing solutions in countries like India and China. Meanwhile, Latin America and the Middle East & Africa are gradually expanding their outsourcing capabilities, driven by economic reforms and growing private healthcare investments.

Medical Billing Outsourcing Market Companies

- Allscripts Healthcare Solutions, Inc.

- R1 RCM, Inc.

- Cerner Corporation

- Experian Information Solutions, Inc.

- eClinicalWorks LLC

- GE Healthcare

- Kareo, Inc.

- Genpact

- McKesson Corporation

- Quest Diagnostics

Key Companies & Market Share Insights

The global medical billing outsourcing market seeks high competition among the market players. Mergers & acquisitions, partnerships, and technological advancement are some of the prime business strategies adopted by these industry participants to expand their regional presence along with the services offered. For example, in July 2019, Cerner Corporation signed a partnership agreement with Amazon Web Services (AWS) to access its global infrastructure and cloud space for driving healthcare IT innovations. The partnership anticipated to enhance the lower operational budgets and clinical efficiency for healthcare organizations. Similarly, in February 2019, Veritas Capital announced to acquire athenahealth, Inc. in collaboration with the Evergreen Coast Capital, as a minority investor.

Recent Developments

- In July 2024, a leading provider of outsourced medical services in the U.S., Omega Healthcare, announced a plan to expand its operations in Philippines. The company aims to double its workforce in the Philippines over the next 25 months.

- In September 2024, EQT announced its plan to buy GeBBS Healthcare Solutions, a leading provider of healthcare technology solutions. This acquisition aims to accelerate the growth of GeBBS to keep up with the demand for RCM (revenue cycle management) services.

Segments Covered in the Report

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2025 to 2034. This report contains market breakdown and its revenue estimation by classifying it on the basis of component, service, end-use, and region:

By Component

- Outsourced

- In-house

By Service

- Back End

- Middle End

- Front End

By End-User

- Physician Office

- Hospital

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/