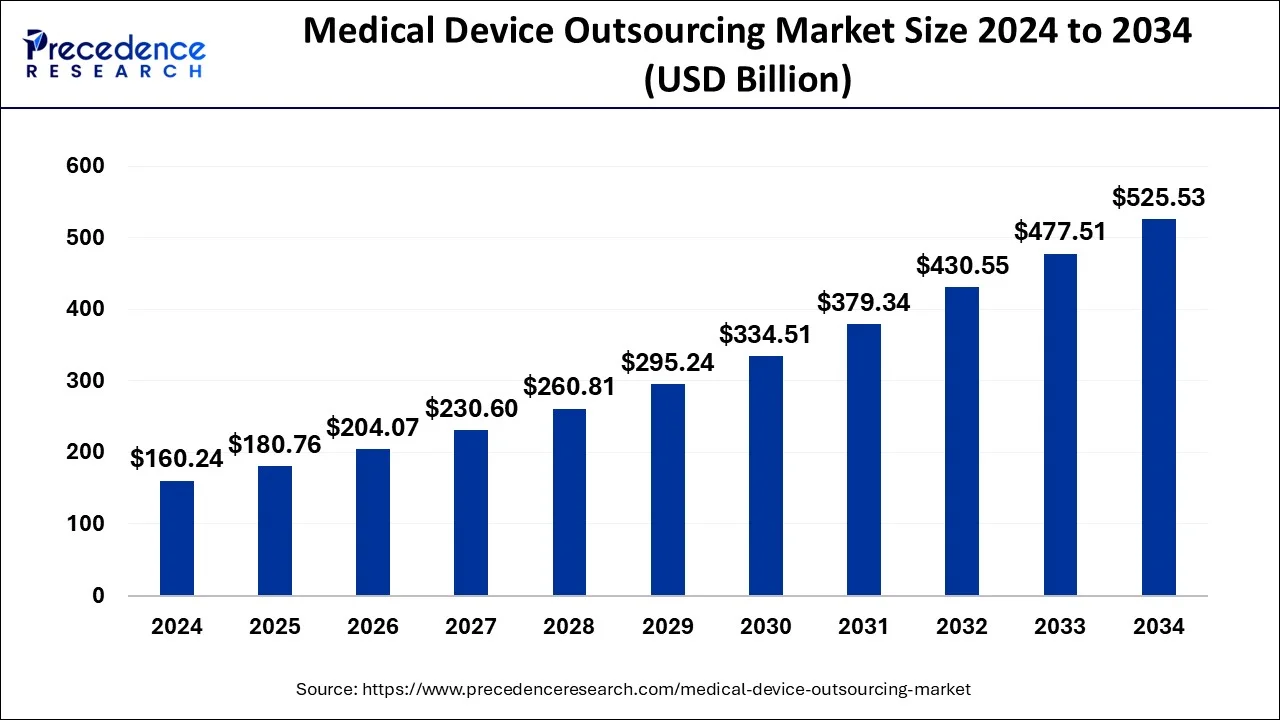

The global medical device outsourcing market size was estimated at USD 160.24 billion in 2024 and is predicted to surpass around USD 525.53 billion by 2034 with a CAGR of 12.61%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1057

Key Points

- Asia Pacific dominated the medical device outsourcing market in 2024, accounting for 41.79% of the total share.

- North America is anticipated to expand at the fastest CAGR of 12.5% in the coming years.

- The cardiology segment was the leading application, securing the largest portion of the market in 2024.

- Quality assurance services held the highest market share of 9.56% in 2024 within the service category.

- Regulatory affairs services are forecasted to experience a double-digit CAGR of 13.5% over the forecast period.

AI’s Role in Advancing the Medical Device Outsourcing Industry

- Smart Manufacturing – AI-driven robotics optimize production lines, ensuring efficiency and precision in medical device assembly, much like a highly skilled, tireless workforce.

- Intelligent Supply Chain Management – AI functions as a real-time traffic control system, predicting delays and optimizing logistics to keep supply chains running smoothly.

- Advanced Market Insights – Like a fortune teller with data-driven accuracy, AI analyzes market trends and customer preferences, helping manufacturers make strategic decisions.

- Risk Assessment and Management – AI acts as an early warning system, identifying potential risks in medical device performance, compliance, and supplier reliability.

- Cost Reduction – By automating repetitive tasks and improving efficiency, AI helps reduce labor and operational costs, much like an expert budget optimizer.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 142.19 Billion |

| Market Size in 2025 | USD 142.19 Billion |

| Market Size by 2034 | USD 430.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.10% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Application Type, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The rapid growth of the medical device outsourcing market is fueled by increasing pressure on original equipment manufacturers (OEMs) to reduce costs while maintaining high-quality standards. The rising burden of chronic diseases and an aging population are driving the demand for sophisticated medical devices, encouraging companies to seek external manufacturing expertise. Regulatory compliance requirements have also become more stringent, pushing companies to outsource regulatory affairs and quality assurance processes to specialized service providers.

Market Opportunities

The adoption of digital health technologies and artificial intelligence in medical device manufacturing is creating new opportunities for outsourcing firms. The shift toward minimally invasive devices and patient-specific medical solutions is driving demand for specialized contract manufacturers. Additionally, the growth of telemedicine and remote patient monitoring is increasing the need for outsourced development and production of connected medical devices. Emerging economies with expanding healthcare infrastructure also present lucrative outsourcing opportunities for global companies.

Market Challenges

The industry faces significant challenges, including regulatory uncertainties, which can delay product approvals and market entry. Intellectual property concerns are another major issue, as outsourcing often involves sharing sensitive design and production details with third parties. The reliance on global supply chains exposes manufacturers to risks such as geopolitical tensions, trade restrictions, and material shortages, potentially affecting production timelines and costs.

Regional Insights

Asia Pacific leads the market due to its cost-efficient manufacturing capabilities and growing expertise in medical device production. North America is expected to grow at a rapid pace, driven by strong investments in innovation and regulatory compliance services. Europe remains a key player, particularly in high-quality contract manufacturing and regulatory consulting. Meanwhile, Latin America and the Middle East are emerging as attractive destinations for outsourcing due to increasing healthcare expenditures and government initiatives supporting medical device manufacturing.

Medical Device Outsourcing Market Companies

- Intertek Group PLC

- TüvSüd AG

- Wuxi Apptec

- SGS SA

- Toxikon, INC.

- Eurofins Scientific

- American Preclinical Services

- Sterigenics International LLC

- Pace Analytical Services LLC.

- North American Science Associates, Inc.

- Charles River Laboratories International, Inc.

Leader’s Announcement

- In November 2024, Shri JP Nadda, Union Minister for Chemicals and Fertilizers, stated on the launching of a Rs 500 crore scheme for the medical device industry in India: “The investment may seem small, but the result is huge.”

Recent Developments

- In August 2024, the U.S. Food and Drug Administration (FDA) provided approval for the Simplera™ continuous glucose monitor (CGM), launched by Medtronic plc, a global leader in healthcare technology. The Simplera™ continuous glucose monitor (CGM) is the company’s first disposable, all-in-one CGM that’s half the size of previous Medtronic CGMs.

- In March 2024, the World Health Organization (WHO) introduced an online platform called MeDevIS (Medical Devices Information System), the first global open-access clearinghouse for information on medical devices. This platform is aimed at supporting governments, regulators, and users in their decision-making on the selection, procurement, and use of medical devices for diagnostics, testing, and treatment of diseases and health conditions.

- In April 2024, the Indian Institute of Technology (IIT) Madras launched India’s first mobile medical device calibration facility. The project is developed under the ‘Anaivarukkum IITM’ (IITM for All) initiative.

Segments Covered in the Report

By Service

- Product Upgrade Services

- Regulatory Affairs Services

- Legal representation

- Clinical trials applications

- Regulatory writing and publishing

- Quality Assurance

- Product Maintenance Services

- Product Testing & Sterilization Services

- Product Design and Development Services

- Molding

- Designing & engineering

- Machining

- Packaging

- Product Implementation Services

- Contract Manufacturing

- Accessories manufacturing

- Component manufacturing

- Device manufacturing

- Assembly manufacturing

By Application

- Drug delivery

- Dental

- Diabetes care

- Cardiology

- Endoscopy

- IVD

- Ophthalmic

- Diagnostic imaging

- Orthopedic

- General and plastic surgery

- Others

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/