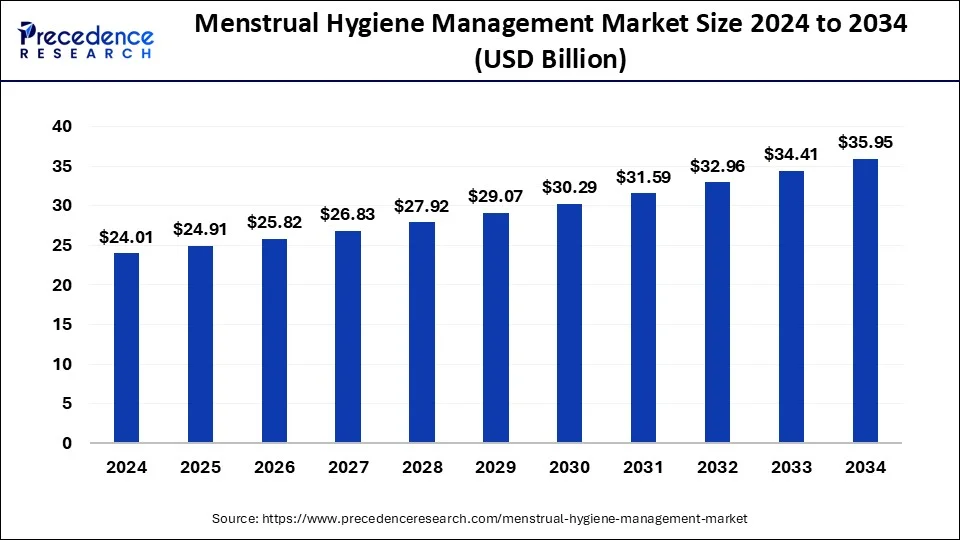

The global menstrual hygiene management market size reached USD 22.40 billion in 2023 and is projected to attain around USD 33.60 billion by 2033, growing at a CAGR of 4.13% from 2024 to 2033.

Key Points

- Asia Pacific has dominated the menstrual hygiene management market and accounted for 39% revenue share in 2023.

- North America is expected to expand significantly during the forecast period.

- Based on product type, the sanitary pads segment held the dominant share of the market in 2023 and is expected to sustain the position throughout the forecast period.

- Based on usability, the disposable segment dominated the market in 2023.

- Based on distribution channel, in 2023, the supermarket/hypermarket segment held a notable share of the market.

The menstrual hygiene management market encompasses a range of products and services aimed at promoting cleanliness, comfort, and health during menstruation. It includes menstrual hygiene products such as sanitary pads, tampons, menstrual cups, and panty liners, as well as related services such as education on menstrual hygiene, access to sanitation facilities, and awareness campaigns. This market plays a crucial role in addressing the needs of menstruating individuals worldwide, contributing to their overall well-being and quality of life.

Get a Sample: https://www.precedenceresearch.com/sample/4103

Growth Factors:

Several factors contribute to the growth of the menstrual hygiene management market. Firstly, increasing awareness about menstrual health and hygiene among both women and men has led to greater acceptance and demand for menstrual hygiene products and services. Educational initiatives, advocacy campaigns, and government policies focusing on menstrual hygiene have played a significant role in driving this awareness.

Secondly, improvements in product innovation and technology have led to the development of more comfortable, convenient, and environmentally sustainable menstrual hygiene products. Innovations such as biodegradable pads, reusable menstrual cups, and organic tampons appeal to environmentally conscious consumers, driving market growth.

Furthermore, initiatives to improve access to menstrual hygiene products and facilities in low- and middle-income countries have contributed to market expansion. Non-governmental organizations (NGOs), governments, and international agencies have undertaken efforts to distribute free or subsidized menstrual hygiene products and to improve sanitation infrastructure in underserved communities, thereby increasing market penetration.

Regional Insights:

The menstrual hygiene management market exhibits variations in demand and consumption patterns across different regions. In developed countries, such as North America and Europe, menstrual hygiene products are widely available and easily accessible through various retail channels. Additionally, there is a growing trend towards sustainable and organic menstrual products in these regions, driven by consumer preferences for natural and eco-friendly alternatives.

In contrast, in many parts of Asia, Africa, and Latin America, access to menstrual hygiene products and facilities remains limited, particularly in rural and impoverished areas. Cultural taboos, social stigma, and lack of education exacerbate the challenges faced by menstruating individuals in these regions. However, efforts to improve menstrual hygiene awareness and access to products and facilities are underway, supported by NGOs, governments, and international organizations.

Menstrual Hygiene Management Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 22.40 Billion |

| Global Market Size in 2024 | USD 23.33 Billion |

| Global Market Size by 2033 | USD 33.60 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.13% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Usability, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Menstrual Hygiene Management Market Dynamics

Drivers:

Several drivers contribute to the growth of the menstrual hygiene management market. Firstly, increasing awareness about menstrual health and hygiene, coupled with changing societal attitudes towards menstruation, has led to greater acceptance and demand for menstrual hygiene products and services. Educational initiatives, advocacy campaigns, and government policies focusing on menstrual hygiene have played a significant role in driving this awareness.

Secondly, improvements in product innovation and technology have led to the development of more comfortable, convenient, and environmentally sustainable menstrual hygiene products. Innovations such as biodegradable pads, reusable menstrual cups, and organic tampons appeal to environmentally conscious consumers, driving market growth.

Furthermore, initiatives to improve access to menstrual hygiene products and facilities in low- and middle-income countries have contributed to market expansion. Non-governmental organizations (NGOs), governments, and international agencies have undertaken efforts to distribute free or subsidized menstrual hygiene products and to improve sanitation infrastructure in underserved communities, thereby increasing market penetration.

Opportunities:

The menstrual hygiene management market presents several opportunities for growth and expansion. One such opportunity lies in addressing the unmet needs of underserved populations, particularly in low- and middle-income countries. By focusing on initiatives to improve access to affordable and culturally appropriate menstrual hygiene products and facilities, companies can tap into new markets and reach a wider consumer base.

Additionally, there is growing demand for sustainable and eco-friendly menstrual hygiene products, driven by increasing environmental consciousness among consumers. Companies that invest in research and development to create innovative and environmentally sustainable menstrual products stand to gain a competitive advantage in the market.

Furthermore, there is potential for collaboration between government agencies, NGOs, and private sector companies to implement comprehensive menstrual hygiene management programs. By working together to address the multifaceted challenges associated with menstrual hygiene, stakeholders can create impactful solutions and drive market growth.

Challenges:

Despite the growth opportunities, the menstrual hygiene management market faces several challenges. One of the primary challenges is the persistence of cultural taboos and social stigma surrounding menstruation, particularly in conservative societies. These attitudes can hinder efforts to promote menstrual hygiene awareness and limit access to products and facilities for menstruating individuals.

Additionally, affordability remains a significant barrier to accessing menstrual hygiene products, particularly for low-income populations. Many menstruating individuals, especially in developing countries, cannot afford to purchase sanitary pads or other menstrual products regularly, leading to adverse health outcomes and productivity losses.

Moreover, inadequate sanitation infrastructure, including lack of access to clean water and private toilet facilities, poses challenges to maintaining menstrual hygiene, particularly in rural and peri-urban areas. Addressing these infrastructure gaps requires concerted efforts from governments, NGOs, and private sector stakeholders.

Read Also: Linear Actuator Market Size to Reach USD 112.90 Bn by 2033

Recent Developments

- In January 2022, a women-friendly project was launched by the government of Rajasthan, India. Known as,” I am Udaan”. This project cost INR 200 crore which is designed to provide free sanitary napkins to each girl and woman in the Rajasthan state regardless of their socio-economic status and their locality.

- In February 2022, Thinx, INC., was acquired by the Kimberly–Clark Corporation. Thinx, Inc. It is a leading provider of feminine care products, such as reusable menstrual products and underwear designed for menstrual days. This acquisition will help the enterprises strengthen their hold in the global menstruation hygiene management market while providing a broad range of personal care products to expand the company’s portfolio.

Menstrual Hygiene Management Market Companies

- Johnson & Johnson Private Limited. (U.S.)

- Procter & Gamble (U.S.)

- Kimberly-Clark (U.S.)

- Essity Aktiebolag (publ) (Sweden)

- Kao Corporation (Japan)

- Daio Paper Corporation (Japan)

- Unicharm Corporation (Japan)

- Premier FMCG (South Africa)

- Ontex (Belgium)

- Hengan International Group Company Ltd. (China)

- Drylock Technologies (Belgium)

- Natracare LLC (U.S.)

- First Quality Enterprises, Inc. (U.S.)

- Bingbing Paper Co., Ltd. (China)

- TZMO SA (Poland)

- Quanzhou Hengxue Women Sanitary Products Co., Ltd. (China)

- Rael (U.S.)

- Redcliffe Hygiene Private Limited (India)

- The Keeper, Inc. (U.S.)

- STERNE (India)

- MeLuna GmbH (Germany)

- Diva International Inc. (Canada)

- Hygienic Articles (Mexico)

Segments Covered in the Report

By Product

- Sanitary Pads

- Tampons

- Menstrual Cups

- Pantyliners

- Menstrual Underwear

- Others

By Usability

- Disposable

- Reusable

By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

- E-Commerce Channels

- Brick & Mortar

- Supermarket/Hypermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/