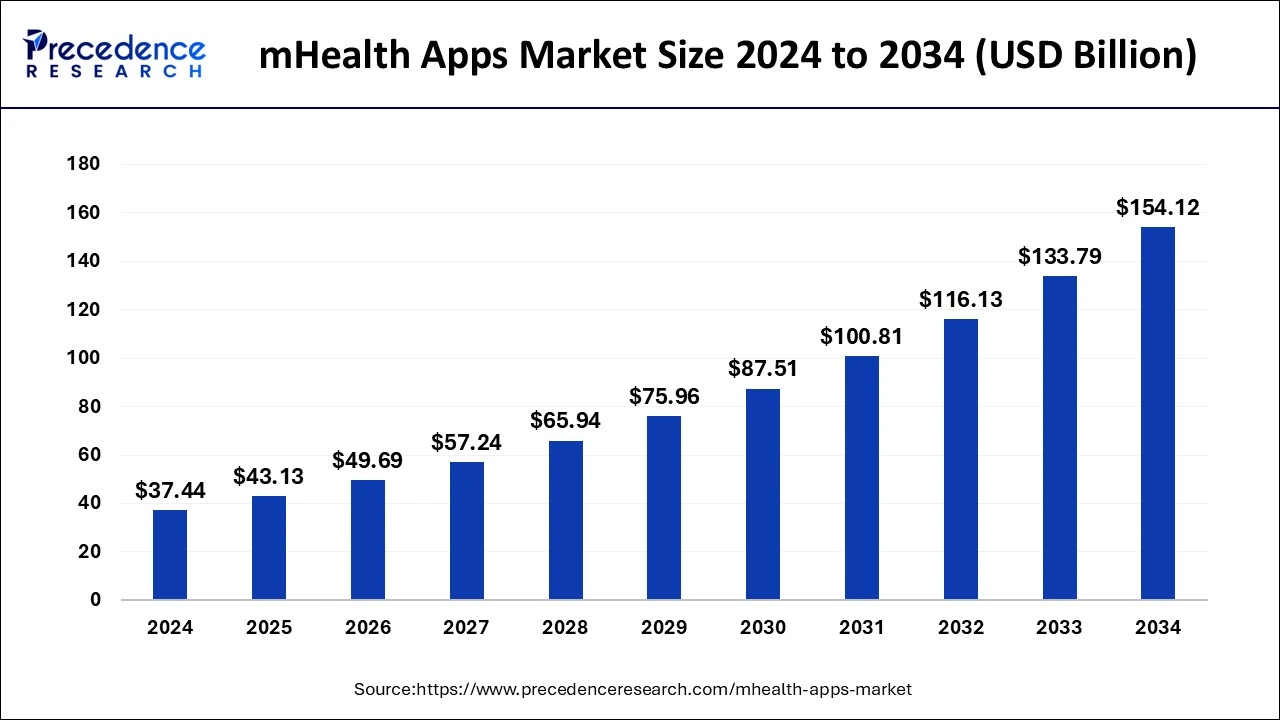

The global mHealth apps market size is projected to cross around USD 154.12 billion by 2034 from USD 37.44 billion in 2024, with a CAGR of 15.20%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1061

Key Points

- North America held the highest market share of 38% in 2024.

- Asia Pacific is anticipated to experience substantial growth in the near future.

- Among different types, medical apps captured the largest market portion in 2024.

- The fitness apps segment is set to expand at a remarkable growth rate over the forecast period.

- The Android segment emerged as the leading platform in 2024.

AI Reshaping the Future of mHealth Apps

- Enhanced Virtual Consultations – AI-driven telemedicine solutions improve diagnosis accuracy and doctor-patient interactions.

- AI-Powered Mental Health Support – AI chatbots and virtual assistants provide emotional support and therapy recommendations for mental well-being.

- Smart Wearable Integration – AI processes real-time data from smartwatches and wearables to offer users actionable health insights.

- Drug and Treatment Recommendations – AI analyzes user history and medical research to suggest appropriate medications and treatments.

- Adaptive User Experience – AI personalizes app interfaces and features based on user behavior and preferences for better engagement.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 43.13 Billion |

| Market Size by 2034 | USD 154.12 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 15.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Platform, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Market Drivers

The rapid technological advancements in mobile health applications are a major driver of market growth. With increasing smartphone and internet penetration, more individuals are using mHealth apps to monitor their health, track fitness goals, and consult healthcare professionals remotely.

The demand for cost-effective healthcare solutions is another significant factor, as mHealth apps provide affordable alternatives to in-person doctor visits. The COVID-19 pandemic further accelerated the adoption of digital health solutions, making mHealth apps an essential part of modern healthcare systems.

Market Opportunities

The integration of mHealth apps with wearable devices and Internet of Things (IoT) technology presents new opportunities for market expansion. Continuous health monitoring through wearable sensors and real-time data sharing with healthcare providers can significantly improve patient outcomes.

The emergence of subscription-based models and premium healthcare services within apps is also driving revenue growth. Additionally, AI-powered virtual health coaches and mental health support applications are gaining traction, offering new business opportunities in the digital healthcare space.

Market Challenges

One of the major challenges facing the mHealth apps market is data security and compliance with healthcare regulations. Ensuring patient data privacy and meeting legal standards such as HIPAA (in the U.S.) and GDPR (in Europe) is critical for app developers and healthcare providers.

The digital divide also poses a challenge, as access to smartphones and reliable internet connections is still limited in certain regions. Moreover, the saturation of the market with numerous apps offering similar functionalities makes it difficult for users to choose reliable and effective solutions.

Regional Insights

mHealth Apps Market Companies

- Abbott Laboratories

- Johnson and Johnson

- AstraZeneca PLC

- Hoffmann-La Roche Ltd.

- Novartis AG

- Bristol-Myers Squibb Company

- GlaxoSmithKline plc

- Merck and Co., Inc.

- Pfizer, Inc.

- iHealth Labs Inc.

- Vivify Health

- Medtronic MiniMed, Inc.

Industry Leader Announcement

- In January 2025, Cipla, a leading pharmaceutical company, announced the launch of a mobile application, CipAir, in India. This app is designed to facilitate the first line of screening for asthma, aiming to empower users by helping them understand their likelihood of having asthma. Achin Gupta, CEO of Cipla, said that this powerful app enables timely intervention against asthma, helping individuals maintain their quality of life.

Recent Developments

- In March 2024, MedWork, a leading provider of health and wellness solutions, entered into a partnership with Lyte Medical, a Canada-based telemedicine company. This partnership marks a significant advancement in providing patient-centric healthcare services.

- In January 2022, Hyphens Pharma International Ltd. launched WellAwaye Pharmacy platform. This platform enables users to access a range of pharmaceutical services as well as helps doctors with teleconsultations.

- In June 2024, Ryde Group Ltd, a leading mobility and fast-growing business, announced a partnership with Mobile-health Network Solutions, Asia Pacific’s first healthcare provider in the US. Ryde and MaNaDr have signed a joint venture agreement to continue their collaboration in telehealth and fast-paced business.

- In February 2024, CHG Healthcare launched two mobile apps, MyCompHealth and MyWeatherby, focusing on creating a one-stop-shop for healthcare providers working locum tenens assignments. These two apps went live in Google Play and Apple App Store, and are for use by providers working assignments with each respective staffing company. These apps allow healthcare professionals to track everything from travel details to shift assignments in one place, all from their smartphones.

Segments Covered in the Report

By Type

- Fitness Apps

- Lifestyle & Stress

- Nutrition & Diet

- Medical Apps

- Disease Management Apps

- Remote Monitoring Apps

- Women’s Health Apps

- Healthcare Providers/Payers

- Others

By Platform

- iOS

- Android

By Regional Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/