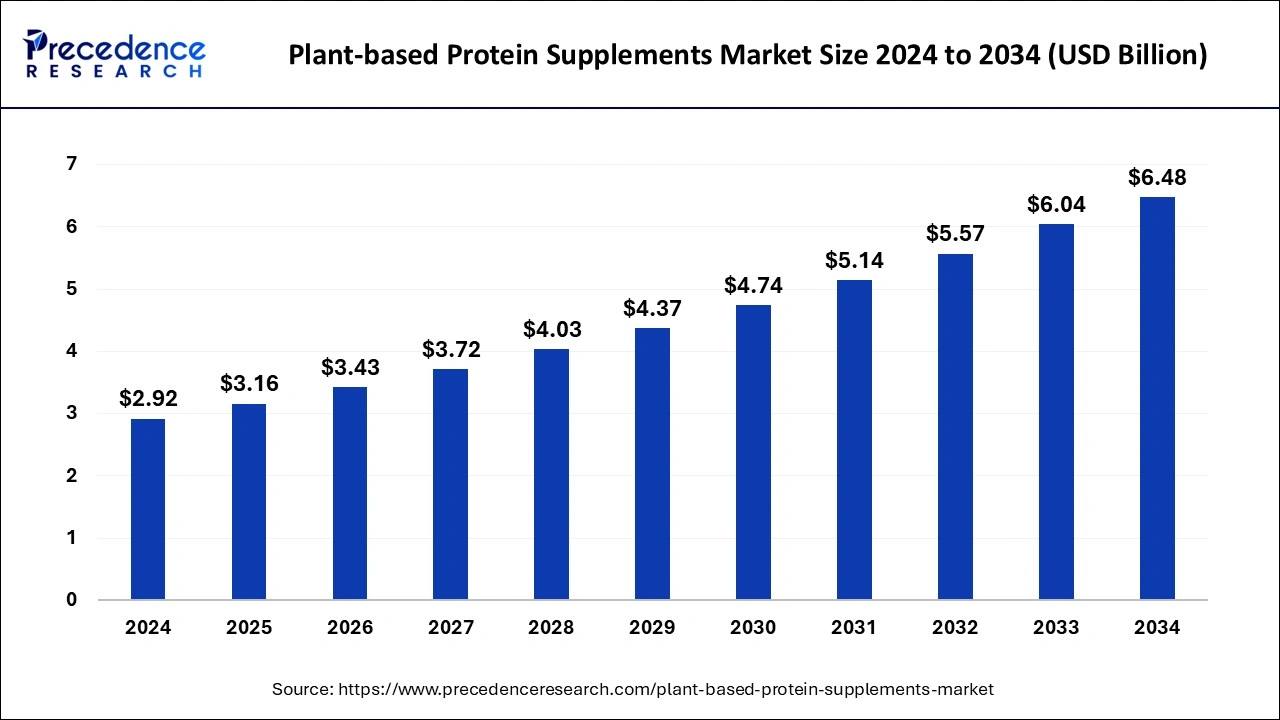

The global plant-based protein supplements market size reached USD 2.69 billion in 2023 and is predicted to be worth around USD 6.04 billion by 2033, growing at a CAGR of 8.42% from 2024 to 2033.

Key Points

- The North America plant-based protein supplements market size accounted for USD 1.24 billion in 2023 and is expected to attain around USD 2.81 billion by 2033, poised to grow at a CAGR of 8.52% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 46% in 2023.

- Asia Pacific is projected to grow at the highest CAGR of 9.63% during the forecast period of 2024-2033.

- By raw material, the soy protein segment has held a major revenue share of 28% in 2023.

- By raw material, the pea protein segment is expected to grow at the fastest CAGR of 9.12% during the forecast period.

- By product, the protein powder segment dominated the market in 2023.

- By product, the protein bars segment is expected to expand at a solid CAGR of 9.21% during the forecast period.

- By distribution channel, the online stores segment dominated the market in 2023.

- By distribution channel, the supermarkets/hypermarkets segment is expected to grow rapidly in the forecast period.

- By application, the functional foods segment has held the largest revenue share of 53% in 2023.

- By application, the sports nutrition segment is expected to grow rapidly in the market during the forecast period.

The plant-based protein supplements market has experienced significant growth in recent years, driven by increasing consumer awareness about health and wellness, along with rising concerns about the environmental impact of animal-based products. These supplements, derived from sources such as pea, soy, rice, and hemp, are popular among a diverse range of consumers including vegans, vegetarians, and those with lactose intolerance. The market includes a variety of products such as protein powders, bars, and ready-to-drink shakes, catering to different dietary needs and preferences.

Get a Sample: https://www.precedenceresearch.com/sample/4357′

Growth Factors

Several factors are contributing to the growth of the plant-based protein supplements market. Firstly, there is a growing trend towards healthier lifestyles and fitness, which drives the demand for protein supplements. Secondly, the increasing prevalence of chronic diseases has led consumers to seek healthier dietary options. Thirdly, the rising awareness about the ethical and environmental issues associated with animal farming has spurred the demand for plant-based alternatives. Additionally, advancements in food technology have improved the taste and texture of plant-based protein products, making them more appealing to a wider audience.

Region Insights

North America currently dominates the plant-based protein supplements market, largely due to high consumer awareness and a strong presence of key market players. Europe is also a significant market, driven by stringent regulations promoting plant-based diets and a high vegan population. The Asia-Pacific region is expected to witness the fastest growth, fueled by increasing health consciousness, urbanization, and a rising middle-class population with disposable income. Countries like China, India, and Japan are key markets within this region, showing robust growth potential.

Plant-based Protein Supplements Market Scope

| Report Coverage | Details |

| Plant-based Protein Supplements Market Size in 2023 | USD 2.69 Billion |

| Plant-based Protein Supplements Market Size in 2024 | USD 2.92 Billion |

| Plant-based Protein Supplements Market Size by 2033 | USD 6.04 Billion |

| Plant-based Protein Supplements Market Growth Rate | CAGR of 8.42% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Raw Material, Product, Distribution Channel, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Plant-based Protein Supplements Market Dynamics

Drivers

The primary drivers of the plant-based protein supplements market include the rising demand for vegan and vegetarian dietary options, the growing incidence of lactose intolerance and milk allergies, and increasing awareness about the health benefits of plant-based proteins. Moreover, environmental concerns and animal welfare issues are pushing more consumers towards plant-based diets. Marketing campaigns and endorsements by health influencers and celebrities also play a significant role in driving market growth.

Opportunities

There are numerous opportunities for growth in the plant-based protein supplements market. Innovations in product formulations to improve taste and nutritional value can attract a broader consumer base. Expanding distribution channels, including e-commerce platforms, can enhance market reach. Additionally, there is potential for growth in emerging markets where awareness about plant-based nutrition is just beginning to rise. Partnerships with fitness centers, health clubs, and dieticians can further promote the adoption of plant-based protein supplements.

Challenges

Despite the promising growth, the plant-based protein supplements market faces several challenges. High production costs and premium pricing can limit affordability for some consumers. There is also significant competition from animal-based protein supplements, which have a well-established market presence. Moreover, taste and texture issues still pose a barrier for some consumers. Ensuring consistent quality and addressing potential allergen concerns, particularly with soy-based products, are additional challenges manufacturers need to address.

Read Also: Portable Ultrasound Devices Market Size, Share, Report by 2033

Plant-based Protein Supplements Market Recent Developments

- In June 2023, Synthite launched Protein, a plant-protein drink powder, and Just Plants, a plant-based dairy alternative, in JV, a food tech joint venture with the IISc (Indian Institute of Science) and a U.S.-based nutraceutical company, PMEDS.

- In September 2023, Natural India Pvt Ltd, the parent company behind Max Protein to reshape the landscape of nutrition and fitness in India, launched 2-revolutionary products: Max Protein Plant Protein and Max Protein Whey Protein.

Plant-based Protein Supplements Market Companies

- Abbott Laboratories

- AMCO Proteins

- Amway

- BENEO GmbH

- Danone S.A.

- Glanbia plc

- IOVATE Health Sciences International, Inc.

- Muscle Pharm Corporation

- NOW Foods

- Quest Nutrition

- Roquette Freres

- Sakara Life, In

- The Bountiful Company

- Transparent Labs

- Tiba Starch and Glucose Manufacturing Company

- WOODBOLT DISTRIBUTION LLC

Segments Covered in the Report

By Raw Material

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

By Product

- Protein Powder

- Protein Bars

- Ready-to-drink

- Others

By Distribution Channel

- Supermarkets or Hypermarkets

- Online Stores

- DTC

- Others

By Application

- Sports Nutrition

- Functional Food

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/