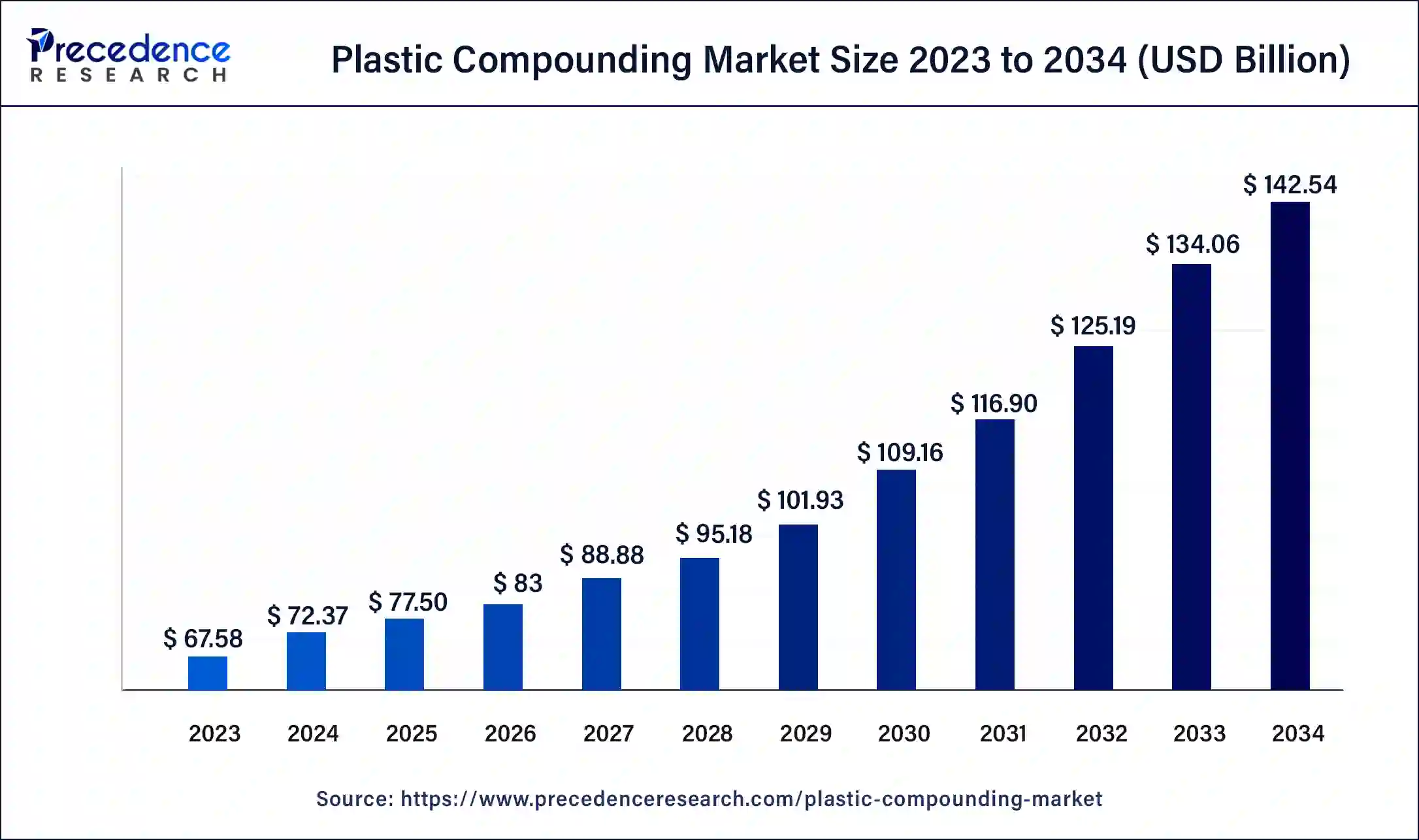

The plastic compounding market size estimated for USD 72.37 billion in 2024 and projected to be worth around USD 142.54 billion by 2034 at a CAGR of 7%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1015

Market Key Takeaway

- In 2023, Asia Pacific dominated the global market, holding the largest market share at 46%.

- The automotive segment accounted for over 26% of the total revenue share by application in 2023.

- The polypropylene (PP) segment was estimated to have the highest market share, reaching 33% in 2023.

- In 2023, Asia Pacific dominated the global market, holding the largest market share at 46%.

- The automotive segment accounted for over 26% of the total revenue share by application in 2023.

- The polypropylene (PP) segment was estimated to have the highest market share, reaching 33% in 2023.

Market Companies

- BASF SE

- Asahi Kasei Plastics

- The Dow Chemical Company

- LyondellBasell Industries N.V.

- SABIC

- Covestro (Bayer Material Science)

Recent Developments

- In October 2022, as part of ongoing initiatives to assist clients in meeting their sustainability goals, BASF Performance Materials Asia Pacific earned several certifications at its Pasir Gudang and Pudong factories.

- In October 2022, Clariant introduces new additives at a K 2022 to aid in the sustainable development of plastics. Applications now have more resilience to facilitate prolonged use and reuse as we move toward circularity.

- In July 2022, Asahi Kasei joined European Bioplastics (EUBP), a group of businesses engaged in the production of bioplastics.

- In February 2022, Celanese Corporation and DuPont struck a legally binding agreement to purchase the majority of the latter’s mobility and material (M&M) business. Celanese is purchasing the DuPont M&M plastics portfolio, divided into two main categories: automotive and electrical/electronics.

- In February 2022, At its manufacturing facility in Paris Gudang, Malaysia, BASF SE increased the production capacity of the products Ultramid polyamide and Ultradur polybutylene terephthalate by 5,000 metric tonnes yearly.

- In January 2021, a key player named Celanese Corporation, which is a worldwide chemical and specialty materials firm, declared a rise in price in the whole plastics engineering category, citing increases in energy, transportation, and raw material prices as well as surged demand for its goods. In resultant, the company’s polyamides and PET costs are expected to climb per kg.

- In May 2019, a key player named the capacity of the plastic compounding plant based in Altamira was increased by BASF. The company further provided plastics engineering product line among which the capacity of production was increased by 15 KT per year including Ultramid and Ultradur. Therefore, this expansion surged the demand for engineering plastics in the Mexico.

Segments Covered in the Report

By Application

- Electronics & Electrical

- Automotive

- Packaging

- Building & Construction

- Industrial Machinery

- Optical Media

- Consumer Goods

- Medical Devices

- Others

By Product

- Thermoplastic Polyolefins (TPO)

- Poly Vinyl Chloride (PVC)

- Polypropylene (PP)

- Polyethylene

- Thermoplastic Vulcanizates (TPV)

- Polystyrene

- Polybutylene Terephthalate (PBT)

- Polycarbonate

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene (PET)

- Polyamide

- PA 6

- PA 66

- PA 46

- Others

By Source

- Fossil-based

- Bio-based

- Recycled

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Italy

- Asia Pacific

- China

- Japan

- India

- Latin America

- Middle East & Africa

- Saudi Arabia

- South Africa

Ready for more? Dive into the full experience on our website@https://www.precedenceresearch.com/plastic-compounding-market