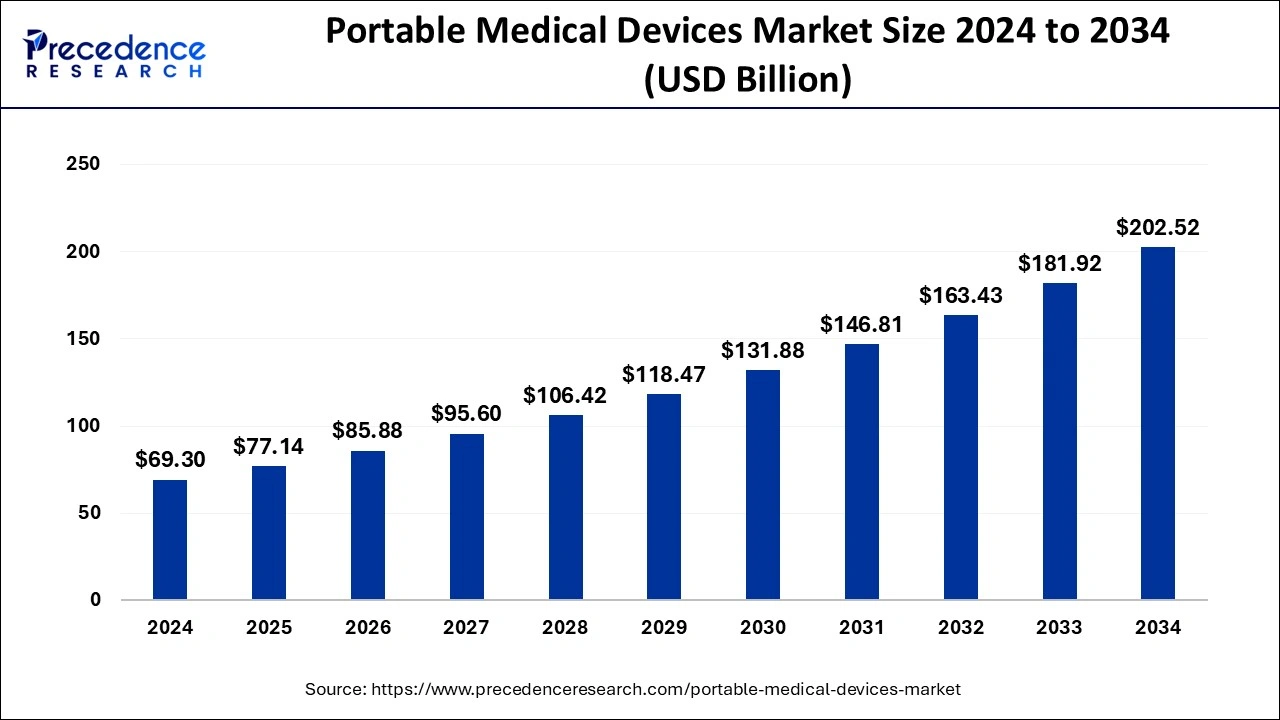

The global portable medical devices market size is estimated at USD 69.30 billion in 2024 and is projected to cross around USD 202.52 billion by 2034 with a CAGR of 11.32%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1068

Key Points

- North America captured the largest market share of 39.39% in the portable medical devices industry in 2024.

- Asia Pacific is forecasted to grow at an impressive CAGR of 12.5% over the upcoming years.

- Among products, monitoring devices dominated with a substantial 49% market share in 2024.

- The gynecology application segment is expected to witness significant growth during the forecast period.

Market Drivers

The rising need for real-time patient monitoring and the growing burden of lifestyle diseases such as diabetes and cardiovascular disorders are major drivers of the portable medical devices market. The shift towards digital healthcare, along with the increasing use of wearable health technologies, has further propelled market growth. Additionally, government initiatives promoting remote patient care and telehealth services are increasing the adoption of portable medical devices across various healthcare settings.

Market Opportunities

There is immense potential for market expansion with the rising demand for portable diagnostic and therapeutic devices in home healthcare and ambulatory settings. The growing trend of personalized medicine and patient-centric healthcare solutions is creating new growth avenues. Technological advancements such as cloud-based health data management and AI-driven diagnostics are expected to enhance device functionality. Emerging economies with improving medical infrastructure and growing digital health adoption present lucrative business opportunities.

Market Challenges

One of the major challenges for the market is the affordability of advanced portable medical devices, which may limit their accessibility in developing regions. Additionally, regulatory hurdles and compliance issues in different countries can slow down product approvals and market entry. The need for continuous technological upgrades and software updates to keep up with evolving healthcare standards is another challenge faced by manufacturers. Concerns over data security and device reliability remain critical areas that require attention.

Regional Insights

North America dominates the market, benefiting from a well-developed healthcare system, early adoption of innovative technologies, and a strong regulatory framework supporting medical device advancements. The Asia Pacific region is expected to expand rapidly due to increasing healthcare awareness, government support for digital health solutions, and rising disposable incomes. Europe follows closely behind, with a strong emphasis on improving patient outcomes through telemedicine and home-based monitoring solutions.

Portable Medical Devices Market Companies

The global portable medical devices market is dominated by the presence of major market players. These players adopt inorganic growth strategies such as mergers & acquisitions, collaboration, and partnership to strengthen their market footprint by developing novel and innovative solutions.

- Samsung Group

- General Electric Company

- Koninklijke Philips N.V

- VYAIRE

- Nox Medical

- OMRON Corporation

- Medtronic Plc

Latest Announcements

- At Pittcon 2024 held in San Diego, US, Richard Crocombe, Principal of Crocombe Spectroscopy Consulting, talked about how wearable health and fitness technology devices are the future of healthcare.

- In July 2024, Molbio’s Truenat technology received global accolade at the 77th World Health Assembly at Geneva. Sriram Natarajan, Founder and CEO of Molbio, where he stressed that the Molbio’s commitment to innovation and excellence, and a drive to create impactful solutions has resonated on a global scale, which he is extremely proud of.

Recent Developments

- In December 2024, the Bureau of Indian Standards (BIS) announced that they will prioritizing development of standards for 214 crucial medical devices. This will be application for devices that set for phased completed by December 2025.

- In June 2024, the US Army Medical Evaluation Test Activity conducted a test of three field portable ultrasound devices. These portable devices are small, lightweight and mobile; they have been approved by the FDA.

- In March 2024, Johnson Matthey Plc (JM) announced that it has signed an agreement to sell 100% of its medical device business (MDC) to Montagu Private Equity (Montagu) for a high cash consideration of USD 7 million.

- In May 2023, OMRON Healthcare India announced their collaboration with AliveCor to launch portable monitoring devices for ECG in India.

- In August 2023, Bonatra launched Wearable Smart Rings. These rings are designed to continuously monitor a range of health parameters, such as sleep score, sleep duration, and readiness score.

Market Segmentation

This research study encompasses comprehensive assessment of the marketplace revenue with the help of prevalent quantitative and qualitative intelligences, and prognoses of the market. This report presents breakdown of market into major and niche segments. Furthermore, this research study gauges market revenue growth and its drift at global, regional, and country from 2016 to 2027. This report comprises market division and its revenue valuation by categorizing it depending on product, application, and region:

By Product

- Therapeutics

- Nebulizer

- Insulin Pump

- Image-guided Therapy Systems

- Oxygen Concentrator

- Smart Wearable Medical Devices

- Diagnostic Imaging

- X-ray

- CT

- Endoscope

- Ultrasound

- Monitoring Devices

- Neuromonitoring

- Electromyography (EMG) Machines

- Electroencephalography (EEG) Machines

- Intracranial pressure (ICP) Monitors

- Cerebral Oximeters

- Others

- Cardiac Monitoring

- Resting ECG System

- Event Monitoring Systems

- Holter Monitors

- Stress ECG Monitors

- ECG Management Systems

- Respiratory Monitoring

- Spirometers

- Capnographs

- Peak Flow Meters

- Neonatal Monitoring

- Fetal Monitoring

- Vital Sign Monitors

- Hemodynamic Monitoring Systems

By Application

- Cardiology

- Orthopedics

- Gynecology

- Urology

- Gastrointestinal

- Neurology

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/