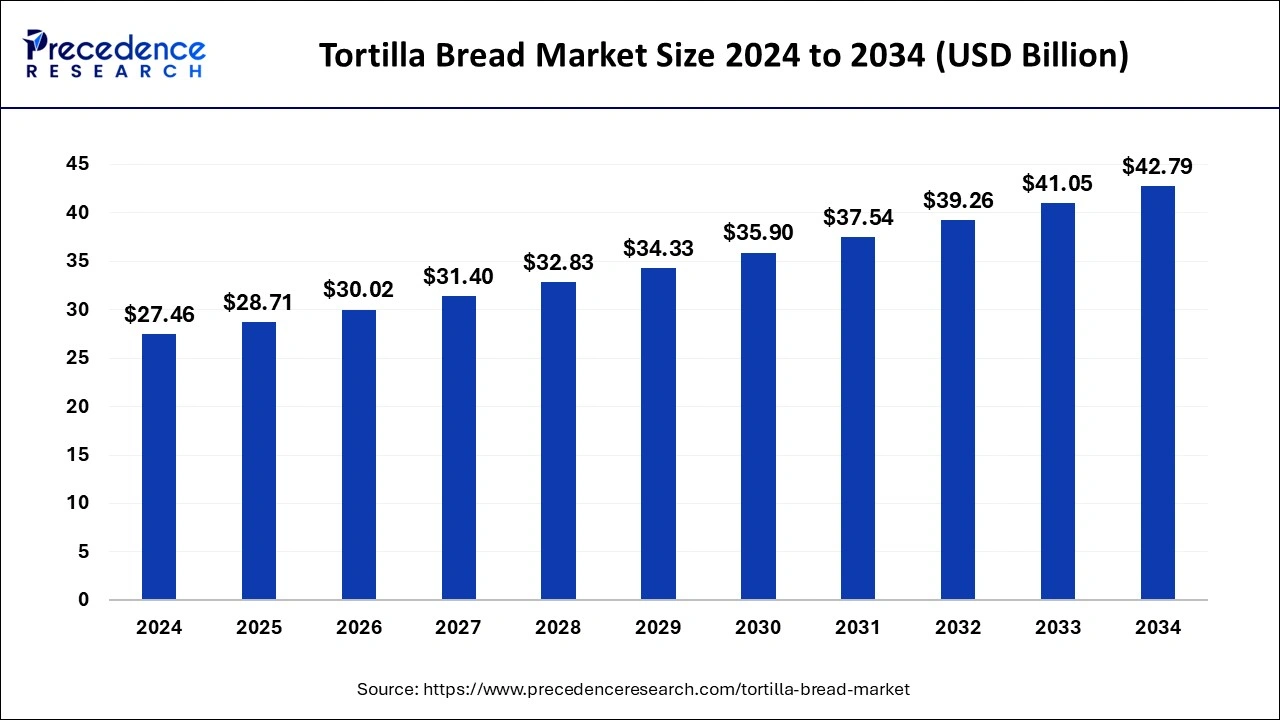

The global tortilla bread market size reached USD 26.26 billion in 2023 and is projected to hit around USD 41.05 billion by 2033, growing at a CAGR of 4.57% from 2024 to 2033.

Key Points

- North America has generated more than 42% of market share in 2023.

- By ingredients, the corn segment has contributed more than 52% of market share in 2023.

- By processing type, the fresh segment has recorded the maximum market share of 63% 2023.

- By product type, the tortilla chips segment dominated the market with the biggest market share of 36% in 2023.

- By distribution channel, the hypermarket/supermarket distribution segment has held a major market share of 37% in 2023.

The tortilla bread market has witnessed steady growth in recent years, driven by the increasing popularity of Mexican cuisine and the growing demand for convenient and versatile food products. Tortilla bread, a staple in Mexican and Latin American cuisine, has gained widespread acceptance across the globe due to its versatility and ability to be used in various dishes such as tacos, burritos, quesadillas, and wraps. The market for tortilla bread encompasses both the retail and foodservice sectors, with a wide range of products available, including corn tortillas, flour tortillas, and specialty varieties such as whole wheat and gluten-free options. As consumer preferences shift towards healthier and more diverse food options, the tortilla bread market is expected to continue its upward trajectory, driven by innovation, product diversification, and expanding distribution channels.

Get a Sample: https://www.precedenceresearch.com/sample/4018

Growth Factors:

Several factors contribute to the growth of the tortilla bread market. One of the primary drivers is the increasing popularity of Mexican cuisine worldwide. The rising number of Mexican restaurants and the integration of Mexican flavors into mainstream food offerings have fueled the demand for tortilla bread. Additionally, changing dietary preferences, including the shift towards healthier eating habits and the adoption of vegetarian and vegan diets, have led to the increased consumption of tortilla bread, which is often perceived as a healthier alternative to traditional bread products. Furthermore, the convenience factor associated with tortilla bread, its long shelf life, and its suitability for various meal occasions contribute to its growing appeal among consumers.

Region Insights:

The demand for tortilla bread varies across different regions, influenced by factors such as cultural preferences, dietary habits, and availability of ingredients. In North America, particularly in the United States and Mexico, tortilla bread holds a prominent position in the food culture and is widely consumed in both households and restaurants. The market in Europe and Asia-Pacific regions is also experiencing significant growth, driven by the increasing popularity of Mexican cuisine and the globalization of food trends. Latin American countries, where tortilla bread originated, continue to be key markets, with consumers preferring traditional corn-based tortillas over flour-based alternatives.

Tortilla Bread Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 26.26 Billion |

| Global Market Size by 2033 | USD 41.05 Billion |

| U.S. Market Size in 2023 | USD 8.27 Billion |

| U.S. Market Size by 2033 | USD 12.93 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Ingredients, By Processing Type, By Product Type, By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Tortilla Bread Market Dynamics

Drivers:

Several drivers are propelling the growth of the tortilla bread market. One of the key drivers is the growing consumer awareness of the health benefits associated with tortilla bread compared to traditional bread products. Tortilla bread, especially those made from whole grains or alternative flours, are perceived as healthier options due to their lower fat and calorie content. Additionally, the versatility of tortilla bread makes it a preferred choice for consumers seeking convenient meal solutions. Its ability to be used as a base for various dishes, as well as its portability, makes it an attractive option for busy lifestyles.

Opportunities:

The tortilla bread market presents numerous opportunities for growth and innovation. One such opportunity lies in the development of gluten-free and allergen-friendly tortilla bread to cater to the needs of consumers with dietary restrictions. Furthermore, there is potential for product diversification and the introduction of flavored tortilla bread variants to appeal to different taste preferences. Expansion into new geographic markets, particularly in regions with a growing appetite for ethnic cuisines, presents another opportunity for market players to capitalize on.

Challenges:

Despite its promising growth prospects, the tortilla bread market faces several challenges. One of the primary challenges is the increasing competition from alternative wrap products and ethnic breads. As consumer preferences continue to evolve, manufacturers need to innovate and differentiate their offerings to remain competitive in the market. Additionally, fluctuating raw material prices, particularly for corn and wheat, can impact the production costs of tortilla bread, posing a challenge for manufacturers. Moreover, issues related to food safety and quality control require stringent measures to ensure compliance with regulatory standards and maintain consumer trust.

Read Also: Tissue Expanders Market Size to Rake USD 1,309.69 Mn by 2033

Recent Developments

- In March 2024, Tortilla Restaurants unveiled an enticing offer for evening diners: a £10 evening meal deal complete with a choice of burritos, tacos, naked burritos, or salads, accompanied by a side of sweetcorn ribs in sour cream, tortilla chips and salsa, or queso fundido.

- In October 2023, Doritos unveiled Doritos Dinamita, a fiery addition to its lineup, tailored specifically for the Indian market. These rolled tortilla chips come in two bold flavors: Fiery Lime and Chilli and Sizzlin’ Hot. Accompanied by a sizzling campaign, Doritos aims to ignite taste buds with its spicy offerings.

Tortilla Bread Market Companies

- Grupo Bimbo SAB de CV

- General Mills

- Aranda’s Tortilla Company Inc.

- Ole Mexican Foods Inc

- Easy Foods Inc.

- Gruma SAB de CV

- PepsiCo Inc.

- La Tortilla Factory

- Catallia Mexican Foods

- Tyson Foods Inc.

- Azteca Foods Inc.

Segments Covered in The Report

By Ingredients

- Wheat

- Corn

By Processing Type

- Fresh

- Frozen

By Product Type

- Tortilla Chips

- Taco Shells

- Tostadas

- Flour Tortillas

- Corn Tortillas

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/