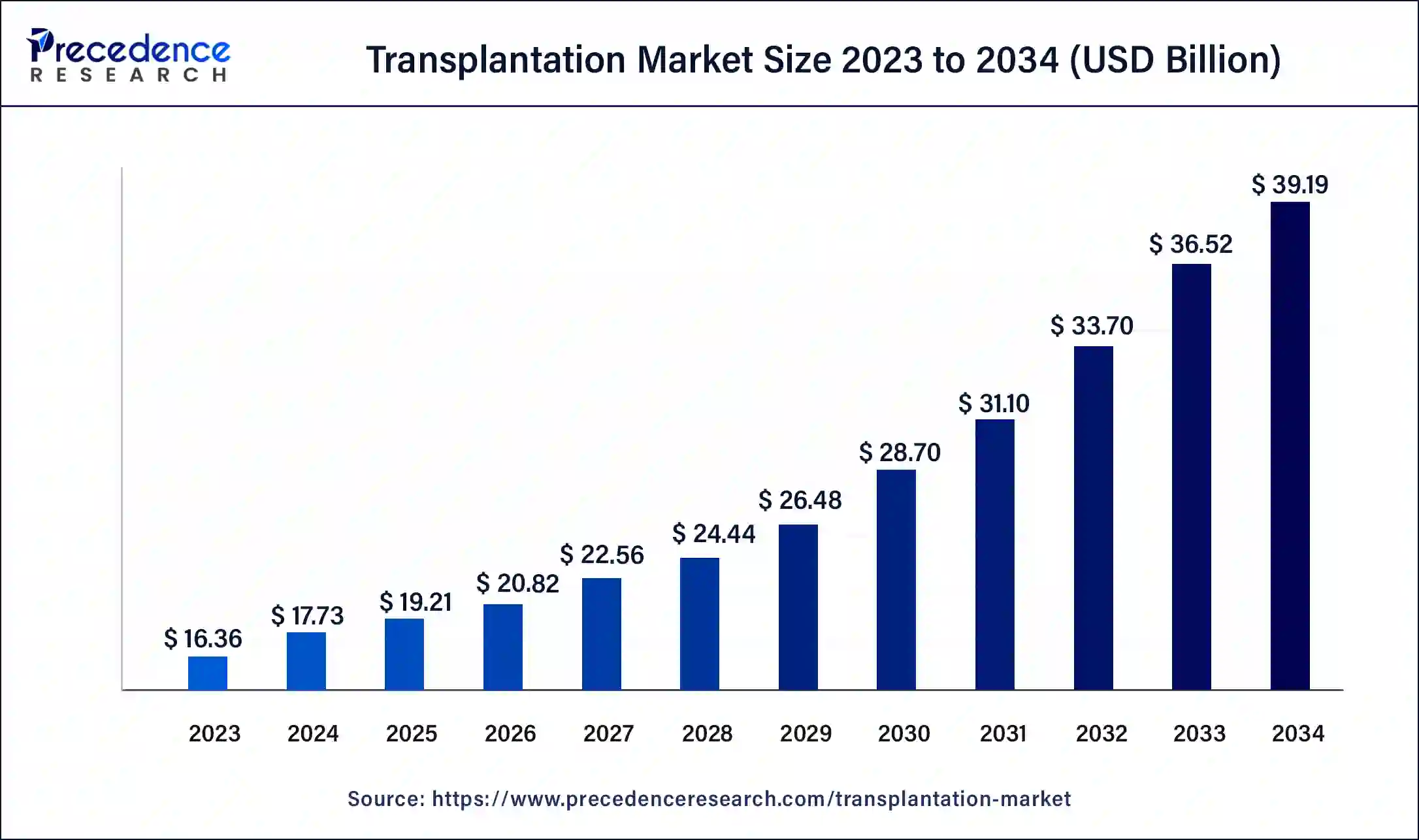

The global transplantation market size is accounted at USD 17.73 billion in 2024 and is predicted to soar around USD 39.19 billion by 2034 with a notable CAGR of 8%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1047

Key Insights

- In 2023, North America secured the highest market share at 42%.

- Asia-Pacific is forecasted to grow at the fastest CAGR over the projected period.

- The tissue products segment generated the maximum revenue share of 59% in 2023.

- The immunosuppressive drugs segment is predicted to grow at an impressive CAGR in the future.

- The tissue transplantation segment dominated with a 62% market share in 2023.

- The organ transplantation segment is set to register the fastest CAGR in the coming years.

- The hospitals segment led with a revenue share of 49.5% in 2023.

- The transplant centers segment is estimated to expand at the highest CAGR during the forecast period.

AI-Driven Precision in Transplantation

AI is significantly transforming the transplantation market by improving efficiency at every stage of the process. Advanced AI models analyze genetic and clinical data to enhance donor-recipient matching, leading to better transplant success rates. Predictive analytics help optimize organ preservation and transportation, reducing waste and increasing organ utilization.

AI-driven robotic systems are also assisting in precision surgeries, ensuring better outcomes for both donors and recipients. Furthermore, AI-powered patient monitoring tools enable real-time tracking of post-transplant health, helping doctors intervene proactively when complications arise.

Drivers

The transplantation market is experiencing steady growth due to the rising incidence of end-stage organ failure caused by chronic illnesses such as diabetes, cardiovascular diseases, and liver conditions. Technological advancements, including better preservation techniques and minimally invasive transplant procedures, are also contributing to market expansion.

Government support through awareness campaigns, funding, and improved healthcare policies plays a crucial role in driving the demand for transplantation services.

Opportunities

The emergence of regenerative medicine and stem cell research presents significant opportunities for the transplantation market. Innovations such as xenotransplantation and artificial organs are being explored to address the shortage of donor organs.

Additionally, increased investment in healthcare infrastructure, particularly in developing nations, is expected to create lucrative opportunities for industry players. The adoption of blockchain technology for organ donor registries could also enhance transparency and efficiency in organ allocation.

Challenges

One of the biggest challenges facing the transplantation market is the imbalance between organ supply and demand. The lack of organ donors, coupled with ethical and legal concerns, continues to hinder progress.

The high cost of transplantation procedures, including post-surgical care and immunosuppressive therapy, makes these treatments inaccessible to many patients. Regulatory hurdles and strict approval processes for emerging transplant technologies further slow down the market’s growth potential.

Regional Insights

North America leads the transplantation market due to its advanced healthcare facilities, a well-established organ donation network, and strong governmental support.

Europe maintains a significant market share, driven by research initiatives and a well-organized donation system. The Asia Pacific region is poised for substantial growth, fueled by increasing medical tourism, rising healthcare expenditure, and efforts to improve organ donation awareness. However, infrastructural limitations and cultural barriers may slow adoption rates in certain regions.

Transplantation Market Companies

- Arthrex, Inc.

- Abbvie, Inc.

- Teva Pharmaceuticals

- Medtronic PLC

- Zimmer Biomet

- Strykers

- Novartis AG

- BiolifeSolutions, Inc.

- 21st Century Medicine

- Veloxis Pharmaceutical

Recent Developments

- In July 2024, Gleneagles Health City, a renowned Indian multi-organ transplant center, launched the uterine transplantation program as part of its Centre for Female Tract Disorders.

- In April 2024, the Mayo Clinic, an American academic medical center, collaborated with the Terasaki Institute for further research to intensify organ transplant outcomes.

- In June 2024, Apollo Cancer Centres launched bone marrow transplant services as outpatient services to make bone marrow transplantation more convenient and reasonably priced.

- In May 2024, Thermo Fisher, an American biotechnology company, launched CXCL 10 testing service to monitor kidney transplant patients.

Segments Covered in the Report

This research study predicts market revenue and its growth rate at global, regional, and country levels and gives inclusive scrutiny of the newest industry drifts in all of the sub-segments from 2020 to 2032. This report categorizes global transplantation market report depending on product type, application, end-use, and region:

By Product Type

- Immunosuppressive Drugs

- Tissue Products

- Preservation Solution

By Application

- Tissue Transplantation

- Organ Transplantation

By End-use

- Transplant Centers

- Hospitals

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/